How To Invest In Stocks For The Future Using Market Gyrations

Interested in the stock market? Do you have some capital that you would like to invest and grow for the future? Would you like to do so by yourself without paying someone to manage it for you? You don't care if you don't get the best return on investment, but want steady and consistent returns?

If the answer to above questions is yes, then you're in luck. There is a proven method that is not complicated and you can use by yourself. It may not generate the best returns possible, but is the best way to invest if you want to grow your capital over the long-term with very little risk.

What you need to know about stock prices

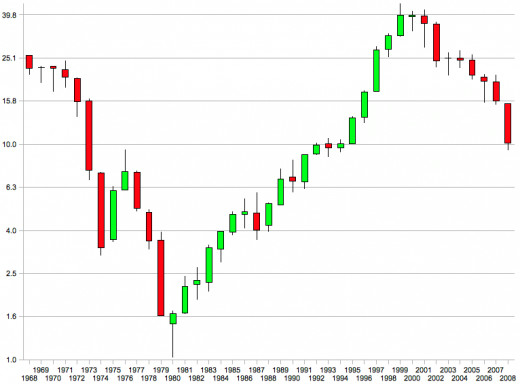

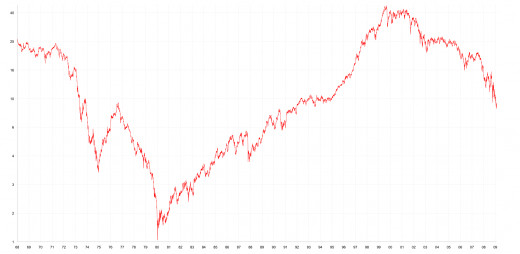

Stock prices do not move in a straight line, but go up and down. Even in a long-term uptrend, there will always be pullbacks and vice versa. This is a fundamental fact about the stock market. You can use this fact to invest by buying low and selling high.

Stocks can go down for any number of reasons, even when it's not warranted. Sometimes, the public gets infatuated with certain stocks, causing other stocks to be sold off. This represents a buying opportunity for you.

As long as you continue to buy low and sell high, you are guaranteed a profit. Do this enough times over an extended period of time and you will grow your investments substantially. Using these market gyrations, you have a viable way of investing for the future.

What you need to have before investing

There are a few thing that you need, including:

- Enough capital. You should start thinking of investing when you have more than $10,000 in cash available. The more money you have, the better.

- The capital you invest must be money you do not need and want to save for the future. It's better not to invest using borrowed money. This includes using margin to buy stocks.

- Enough time. Relying on market gyrations requires time. It is not for the short-term. You must be willing to invest for at least 10 years or much longer.

- Patience. Investing requires time. You have to give it enough time for your money to grow.

How to choose which companies to invest in

If you like to invest in the stock market, you need to know which companies to invest in. While smaller companies have the potential for greater returns, it's best to stick with large companies to minimize risk. Here's some guidelines and tips to use for selecting companies to invest in:

- Select only companies with a market cap of over $10 billion. If you're willing to take on more risk, you can choose smaller companies.

- Select companies with staying power. That is, companies that have been around for a long time and are likely to remain so due to the nature of their business.

- Look for companies that are diversified with a broad product portfolio. You don't want companies that are dependent on just one or two means of income.

- Give preference to companies with strong brand recognition. Brands make it hard for the competition to displace the company you invest in.

- Dividends are a major plus. Especially when companies have a track record of raising them over time.

- Some examples of companies that fit are: Coca-Cola, Colgate-Palmolive, Disney, IBM and many others.

In addition, there are a few other tips that you can use:

- Choose companies that are in the public eye and you are familiar with. If you don't like their products or their service, chances are other people don't either. Avoid these companies.

- Always decide for yourself. Don't invest in a company only because someone else told you to do so.

- Do not hesitate to get out of the stock market. If you feel stock prices are too high, then you can simply move into cash and wait until prices drop.

- Be disciplined as an investor. Stick to a proven method and do not let emotions influence your decisions.

How to invest long-term using the ups and downs in the stock market

Once you know which companies you want to invest in over the long-term, you can proceed using the following guidelines:

- You need a basket of about 10 companies to invest in. Add another five companies in reserve.

- Allocate the total amount of capital you would like to invest in the stock market between the number of companies.

- Start buying companies that are at or near their 52 week low and hold on to it.

- Once that company is at or near its 52 week high, sell your shares and close the position.

- Replace that company with another company in reserve that is at its 52 week low.

- Keep repeating the previous three steps.

- You have to decide if you want to use a stop-loss at say 25 percent. Alternatively, you can ride out a temporary loss and wait for the stock to recover.

- Make sure that no company takes up more than 15 percent of your portfolio. If is nears that number, trim the position by selling shares.

- You can adjust this method as you see fit. For example, you can add more companies, but that requires more work to keep track of them all.

The basic method is to always buy low and sell high. Never buy companies that are making new highs. If you continue to buy shares when they are cheap and sell them when they're expensive, then you should come out ahead over the long term. Provided of course, you give it enough time.

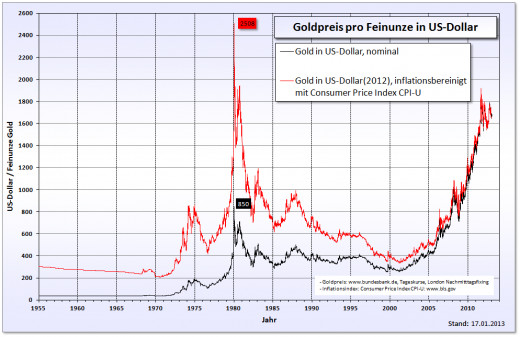

What this method of investing can and cannot do

The previous method of investing is not for everyone. It requires some homework on your part and is not simply buy and hold. You need to keep track when stock prices make a new high or new low. Some people may not want to do this due to the time and effort required.

It will not give you highest possible returns possible. If you want to maximize profits or are in a hurry, you need to find another way of investing that does not rely on market gyrations. It is not some quick get-rich scheme.

However, you also do not need to pay someone to manage your assets for you. It's designed to be simple so that most people can do it by themselves. You are essentially in control of your own destiny, which can be a good thing. It's all entirely up to you to shape the direction of your future.

If you're interested in growing your assets with relatively little risk and you can wait, then using market gyrations is something you want to look into. If you give it enough time, you are almost certain to see returns that outperform bonds, certificate of deposits and other types of fixed income.